Although low-power wide-area networks have decades of development history, they have only entered people’s horizons for about three years. In these three years, the industry has experienced many ups and downs, from a hundred schools of thought contending to the status of a handful of remaining mainstream technologies. Whether it is NB-IoT/eMTC based on licensed spectrum, or LoRa and Sigfox based on unlicensed spectrum, one of the main forces behind their eventual becoming mainstream technologies is the formation of a huge global ecosystem. In addition, the low-power wide-area network market will also present some new features.

The number of LPWAN connections has increased significantly

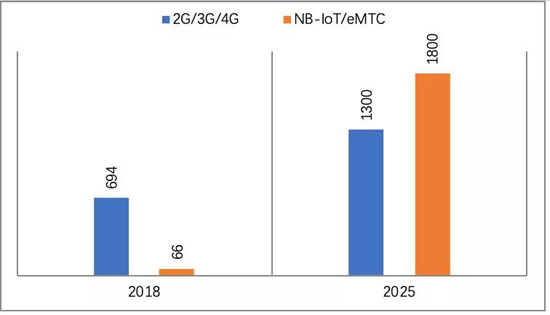

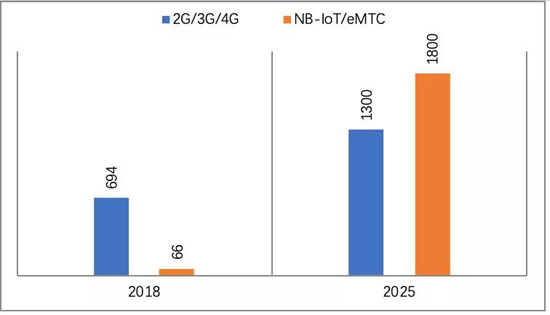

Judging from current data, the number of global cellular IoT connections mainly comes from traditional 2G/3G/4G. In the next seven years, traditional cellular networks will still carry a large number of IoT connections, but NB-IoT/eMTC will gradually exceed 2G /3G/4G has become the mainstream connection method. The latest forecast data released by the GSMA are as follows:

Number of cellular IoT connections worldwide (millions; source: GSMA)

It can be seen from GSMA’s forecast data that by the end of 2018, the number of IoT terminals connected through 2G/3G/4G is expected to be 694 million, and the number of terminals connected through NB-IoT/eMTC based on licensed spectrum LPWAN technologies is expected to be 66 million , the latter accounts for only 9%. By 2025, the number of 2G/3G/4G IoT connections will increase to 1.3 billion, while the number of NB-IoT/eMTC connections will increase to 1.8 billion.

Since traditional cellular networks still carry a large number of IoT connections, many applications that require high bandwidth require 3G/4G network connections. In addition, the current 2G network industry chain is very mature and the cost is extremely low, making 2G/3G/4G in the next few years. It is still one of the main carrying facilities for cellular IoT connections, but its growth rate is relatively slow, with a compound annual growth rate of only 9.38% from 2018 to 2025. As for NB-IoT/eMTC, the growth rate will accelerate as the industry chain matures. In the next few years, it will achieve an annual growth rate of more than 60%, causing its proportion of the number of cellular IoT connections to increase from 2018 to 2018. 9% will grow rapidly to 58% in 2025, becoming the main carrier of cellular IoT connections.

In terms of LoRa, due to its flexibility in network construction, the global industrial ecosystem has gradually matured. In the future, more companies will join the LoRa camp, especially companies that want to become new operators in the Internet of Things era, and there will be greater enthusiasm for participation.

According to data from the internationally renowned organization IHS Markit, the number of LoRa network connections was 32 million in 2017, and is expected to exceed 57 million in 2018. In 2022, this number will reach 350 million. Compared with NB-IoT/eMTC, LoRa technology is more likely to be favored by non-traditional operators such as Internet companies and radio and television operators.

LoRa IoT connection number forecast

The situation of “one dominant operator” among operators will change

In the era of person-to-person communication services, only a few companies in each country serve as operators. The towering barriers to entry make the market concentration in this field very high, shutting out other companies. After the demand for wide-area and mobile IoT applications emerged, telecom operators took on this role again and provided services to IoT users through their own cellular networks, which were still inaccessible to other enterprises.

However, the rise of various low-power wide-area network technologies is breaking this pattern. Judging from the current situation, manufacturers providing low-power wide-area network connection services are no longer the “privilege” of traditional telecom operators. Different network sizes Multiple new network “operators” have participated in the network and business scope, forming a diversified pattern. Based on the characteristics of low-power networks, the dominance of telecom operators is changing. Diversified demands have led to the emergence of some different structures in the market, which can be roughly divided into two camps: carrier-level and industry-level/enterprise-level.

1. Carrier-level camp

Based on global network coverage capabilities, the carrier-level camp can quickly deploy global low-power wide-area networks. Currently, NB-IoT/eMTC has become the main choice for the core infrastructure of cellular IoT services for mainstream operators around the world.

Before the emergence of low-power wide-area networks, operators with multinational networks were already providing global M2M IoT services to customers around the world. In the development of licensed spectrum low-power wide-area network standards, operators and communication equipment vendors are active supporters and participants.

Different from the mobile Internet era, more companies can participate in the construction and application of low-power wide area networks, and some industries will no longer be monopolized, such as the chip industry, Huawei HiSilicon, Qualcomm, MTK, ZTE Microelectronics, Domestic and foreign companies such as Spreadtrum Ruideko are actively engaged in research and development and mass production.

The value of the IoT industry chain is more concentrated in the platform layer and application layer. Therefore, when it is difficult to shake the market share of operators and communication equipment companies, providing solutions in vertical fields is a good entry point. Of course, Relying on their own advantages, operators and communication equipment companies are also working in this field. While technological progress and user demands have increased market capacity, they have also increased competition among participants. Leaders in various fields are penetrating the industry horizontally and vertically.

2. Industry-level/enterprise-level camp

Different from LPWAN dominated by telecom operators, unlicensed spectrum LPWAN networks rely more on market choices to gain survival opportunities. There are more than a dozen similar technologies in the world, but only a few can truly succeed. The reasons can be summarized as the utilization of the right time, location, and people, grasping the time window, regional application expansion, and the creation of an industrial ecology are all crucial. It is foreseeable that when encountering problems such as shortage of funds and market expansion, most unlicensed spectrum LPWAN technologies will find it difficult to survive. For hardware companies such as modules, gross profit margins are generally low, and small companies are very difficult to survive. It is easy to be acquired by companies with strong capital, forming large-scale competitiveness.

The flexibility of LoRa can bring more opportunities to the industry, and a large number of decentralized enterprises can participate in LoRa network operations. However, this situation has brought about a very fragmented and different standard result. In this field, Internet giants can take advantage of their cloud platform capabilities to integrate these decentralized operator resources.

Compared with telecom operators, LoRa can be deployed on demand and in a small scale. However, not all enterprises have the ability or need to establish their own core network, network management, and billing systems. They can completely rely on third-party existing cloud platforms. Network operations can be quickly implemented.

Each decentralized operator deploys a dedicated LoRaWAN standard for the access network part, and uses the cloud platform provided by the Internet giant after backhaul. The core network part has unified specifications for this cloud platform, ensuring to a certain extent LoRa network end-to-end standardization. Since LoRa’s core network, network management, and billing system are guaranteed by Internet giants, it can form a large system capable of handling ultra-large connected IoT networks. It is entirely possible for a large number of dispersed LoRa networks to form city-level coverage. Of course, this is a gradual process.

Complementarity between different technologies

Generally speaking, whether it is the operator-level camp or the industry-level/enterprise-level camp, industry chain attributes such as chips, modules, terminals, communication equipment, platforms, applications, and organizations are indispensable. The difference lies in the participation in The market concentration, enterprise composition, and the role of various enterprises in each link.

It is easy for the operator-level camp to form global and regional low-power wide-area networks. This is due to the inherent advantages of operators and policy support. With the evolution of the market and the strong financial resources of operators, it is entirely possible to pass It integrates a series of industrial chain links through acquisitions and other means, and eventually becomes a leader in the non-operator field.

However, judging from the current communication network coverage, operators cannot cover all areas, such as harsh environments, remote areas, or complex environmental scenarios like mines, and LPWAN is required in these scenarios. In addition, for data security reasons Consider that self-built networks are very suitable in many scenarios.

LoRa is easily favored by users because of its flexible network deployment method. As we all know, the future LPWAN market will be diversified, long-tailed, and customized, and a large part of it will be supported by non-operator camps. The industry-level/enterprise-level camps will work harder to expand their network’s global and regional territory, integrate various resources, and the ecological advantages will make the market advantages more obvious, and gradually develop from scenario-based and localized to regionalized. Of course, , competition between different technologies will also become more intense.

LoRa diversified network construction modes

With the active promotion of mainstream operators, equipment manufacturers and other industry giants as well as the international standards organization 3GPP, NB-IoT/eMTC can easily achieve large-scale and global coverage, focusing on the “big market”. With the promotion of small and medium-sized enterprises and the urgent need for personalized network construction, LoRa has been able to shine in deployment in various scenarios, focusing on “small markets” and “long tail markets”. From a scale perspective, due to diversified and fragmented scenario demands, the long-tail market will also account for half of the country in the future. The two form a complementary relationship in the market, jointly improving the IoT network layer and promoting the rapid development of the IoT industry.

The “operator for everyone” model is expected

As mentioned above, “operator” is no longer exclusive to telecom operators. As long as the manufacturer has assets that can be used repeatedly (tangible products or intangible services), charging multiple users to lease them is the operator of its assets. With the help of low-cost IoT technologies such as power wide area networks make it possible for “everyone to be an operator”.

Today, low-power wide-area network technologies such as NB-IoT/eMTC and LoRa are racing around the world, and the networks they deploy have a strong shadow of virtual operators. The operators of these IoT networks also have different levels of participation in telecom operations. Relying on the flexibility of LoRa and the support of third-party network platforms can help enterprises quickly build networks and launch network operations. Third-party platforms can help many operators build core networks and operations support systems (OSS), rather than just a platform for connection management and application enablement, thus forming some deeply involved operators; while some industry-level and enterprise-level The LoRa network mainly provides connections and data is directly connected to the Internet. The participation of such operators is relatively shallow.

For “product” operators, various product “operators” can conduct life cycle management and operation and maintenance of their products, and provide various additional services based on the product basis. In order for these manufacturers to become “operators”, they need the support of infrastructure technologies such as IoT communications and management platforms. Currently, the number of manufacturers providing these supporting technologies is relatively abundant, and product operators can choose to build and operate these infrastructures themselves. , these facilities can also be rented. Similar to the different categories of virtual operators, product operators can have different depths of involvement.

As the Internet of Things penetrates more and more into our production, operations and personal lives, there will be more and more “operators” of various reusable products. They use Internet of Things technology to supervise, operate and maintain the products they operate. Operations such as positioning and billing form various product “operators” with different levels of participation. When dedicated IoT networks such as LoRa are gradually deployed around the world and their supporting industry chains mature, smaller organizations and even individuals begin to use these technologies to operate their assets, allowing various lightweight product “operators” to The threshold is further lowered. One of the industrial changes brought about by the Internet of Things in the future is the product “operator” group of various industries and sizes.

Of course, the development of low-power wide area networks is also inseparable from the collaboration between standards and industry. The establishment of standards can promote the development of the industry in an orderly and large-scale direction, while the progress of the industry will have a reverse effect on the improvement of standards. The two are A mutually reinforcing and complementary relationship. In addition, some clear regulatory measures will be formed for low-power wide-area networks in the future. Compared with the past process of allowing the market to develop freely, I believe that orderly supervision will become the norm in the future. Not only the spectrum field, but also data, platform and other fields will also usher in the era of supervision. Of course, regulation strives towards a fair market competition environment, rather than having an obvious technical bias.