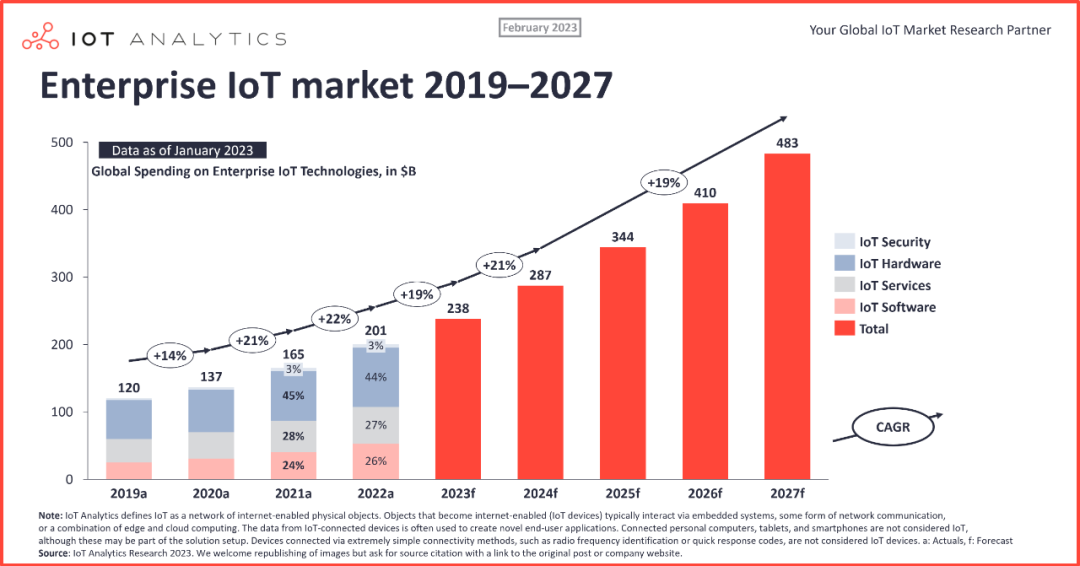

Recently, the market research organization IoT Analytics released a tracking research report on global enterprise IoT expenditures. The report shows that in the past 2022, global enterprises in various industries spent approximately US$201 billion on the Internet of Things, a year-on-year increase of 21.5%. It is not easy to achieve this growth under the influence of the global economic downturn in 2022 and the epidemic interrupting normal production. It is expected that by 2027, global corporate spending on the Internet of Things will reach US$483 billion. This scale of spending is basically the purchase of related products and services in all aspects of the IoT industry chain, becoming the main income of IoT companies in the next few years. source.

Affected by multiple factors in the global economy, IoT expenditures vary significantly in different regions.

In March last year, IoT Analytics predicted that global enterprise IoT spending would grow at a 24% annual rate in 2023, mainly based on expectations that the world economy will recover faster, supply chains will recover faster, and continued investment in new technologies will Optimistic projections to alleviate labor shortages. However, based on the economic environment of the past year and expectations for 2023, IoT Analytics lowered the IoT spending growth forecast for 2023 to 19%. The forecast to lower the growth rate is mainly based on some macroeconomic factors, because macroeconomic development will significantly affect corporate investment decisions, including GDP growth, inflation and interest rates.

From 2022 to 2027, enterprise spending on the Internet of Things will grow at a compound annual growth rate of 19.4%, reaching US$483 billion by 2027. There are obvious differences in the growth rate of IoT spending by enterprises in different regions. It is expected that between 2022 and 2027, the compound annual growth rate of IoT spending by enterprises in the Asia-Pacific region will reach 22%, surpassing other regions in the world; the compound annual growth rate in North America is 20 %, slightly lower than the Asia-Pacific region, while Europe is only 16%.

IoT hardware accounts for the largest share of expenditures, and IoT services have huge potential

In terms of expenditure structure, IoT Analytics divides IoT expenditures into four categories: IoT software, IoT services, IoT hardware and IoT security. In the past 2022, enterprises spent the most on IoT hardware, accounting for 44%, followed by IoT software and IoT services, accounting for 27% and 26% respectively. Spending on IoT security was the lowest, accounting for 3 %.

The most expensive IoT hardware includes sensors, IoT chips, IoT modules, IoT terminals and other equipment. Judging from expenditure data, the scale of this field has exceeded US$88 billion. In this field, domestic companies perform outstandingly. According to the global shipments of IoT chips and modules, taking cellular IoT chips and modules as an example, Chinese companies will account for 6 of the top 10 cellular IoT chip manufacturers in the world in 2022, with a market share of 55% Above; the top five global cellular IoT module companies are all Chinese companies, with a market share of over 60%.

IoT software is largely available in the form of IoT platforms. According to the tracking of IoT Analytics, there are more than 600 influential IoT platforms in the world. These more than 600 platform providers mainly focus on the US$54 billion IoT software spending market. In recent years, the reshuffle of IoT platforms has accelerated. Especially since the second half of last year, many large companies with global influence have withdrawn from IoT platform services, including Google, Ericsson, SAP, IBM, Bosch and other manufacturers, which has brought great consequences to the industry. With a huge impact, IoT platforms are gathering towards bigger heads, and at the same time, some vertical fields are strengthening self-built IoT platforms.

Internet of Things services are specific application service solutions provided to enterprise customers based on hardware and platforms. They are not only delivered to users in the form of SaaS, but also have specific implementation consulting and service solutions, such as predictive maintenance, asset management, tracking services, etc. The groups that provide IoT services are familiar with the production and operation processes of specific industries and can design appropriate solutions for customers, achieve their goals of cost reduction and efficiency improvement, and achieve business innovation.

The share of IoT security investment has stabilized at 3% in the past two years. As the scale of IoT deployment increases and the number of connected devices increases, the security situation will become increasingly severe. It is expected that the proportion of IoT security expenditure will usher in substantial growth. .

From the perspective of corporate expenditure structure, expenditure on IoT hardware will account for 44% in 2022, which is only a 1% decrease compared to 2021, which is still much higher than IoT services. For a long time, in the industry’s understanding of the value of the Internet of Things, the ideal state is that Internet of Things services account for the highest proportion. Since IoT services involve various scenarios in specific industries, are closely related to the innovation of enterprise production and operations, and have greater imagination, IoT services will become the largest area of IoT expenditures in the future.

Résumer

Overall, the IoT market has huge scale and potential, and is becoming an important driver of digital transformation in all walks of life. Hardware is still the foundation for the construction and application of the Internet of Things, but software, services and security are also crucial components. With the continuous development and application of IoT technology, it is believed that the scale and share of the IoT market will continue to expand, and it will also have a profound impact on people’s lives and work styles.