As the integration of Internet infrastructure and traditional economy, cloud computing has promoted the accelerated development of local economy. With the further integration of Internet of Things, artificial intelligence, big data and cloud computing, the depth and breadth of cloud services have been further extended. Cloud computing is the best digital solution for traditional industries that is efficient, low-cost, safe and stable, and can promote data flow. In the past two years, the development of cloud computing in local cities in my country has entered a rapid era. Beijing Xiangyun Project, Shanghai Yunhai Project, Guangzhou Sky Local cloud computing plans such as the Cloud Plan, Shenzhen Kun Cloud Plan, and Chongqing Cloud Plan have blossomed across the country. Hainan, Shaanxi, Hebei and other provinces have actively embraced the Internet. Cloud computing and big data are also top priorities in Shandong Province’s plan to transform old and new growth drivers. . For third- and fourth-tier cities whose steady economic growth relies on government affairs and traditional industries, cloud computing is a new growth engine.

Cloud computing technology IaaS and SaaS technology are relatively mature, and the world has begun to enter a stage of explosive growth. According to the latest IDC research survey on global public cloud service expenditures, global public cloud service and infrastructure expenditures are expected to reach 2018. 160 billion US dollars (the domestic scale will be 30 billion US dollars), an increase of 23.2% compared with 2017, although the annual expenditure growth rate of the public cloud industry market is expected to slow down in the five years from 2016 to 2021. , but the market will have a compound annual growth rate of 21.9% by 2021.

1. Market Current Situation

(1) Analysis of the current situation of the global public cloud market

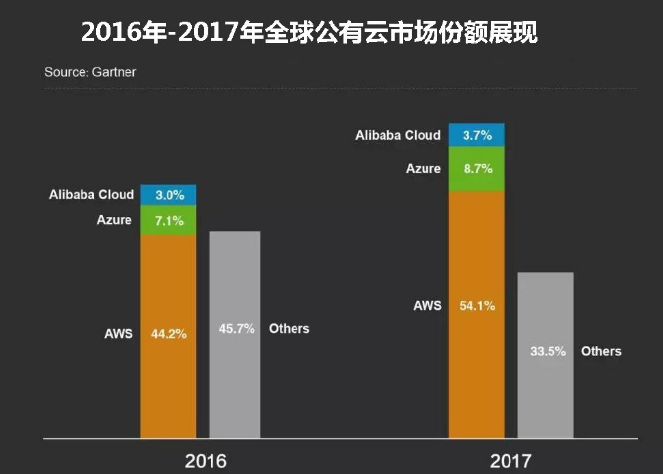

Recently, Gartner, a world-renowned consulting organization, released the 2017 global public cloud IaaS market share analysis report. According to the data released in the analysis report, AWS, Microsoft (Azure), and Alibaba Cloud ranked among the top three.

The United States is the country with the fastest growing public cloud in the world. Amazon’s public cloud AWS operating revenue reached US$12.221 billion in 2017, with a market share of more than 50%. However, due to a large base, the growth rate slowed down to only 25%; Microsoft’s cloud Azure business Revenue reached US$3.13 billion, with a growth rate of nearly 100% (98.2%) as the highlight; Google Cloud revenue was US$780 million, a year-on-year increase of 56%; IBM public cloud revenue was US$457 million, a year-on-year increase of 53.9%. Among the top five public cloud vendors, American vendors account for more than 60% of the global market share.

Alibaba Cloud ranks third in the world and is the only Chinese cloud service provider selected for the short list. Its IaaS revenue in 2017 was US$1.09 billion, with a growth rate of 62.7%.

The three cloud service providers Amazon AWS, Microsoft Azure, and Alibaba Cloud collectively monopolize 66.5% of the market share. Comparing the share histograms in 2016 and 2017, we can clearly see that this oligopoly trend is becoming more and more obvious.

Global public cloud market share from 2016 to 2017 Data source: Gartner 2018.7

Any emerging market will experience an early explosion period, a period of chaotic competition, and finally a centralization movement. Take travel services as an example. At the beginning, Didi, Kuaidi, Uber, Yidao Yongche, Shenzhou Private Car and others competed for the top spot. After rounds of hand-to-hand battles, Didi finally won the game and accounted for more than 80% of the market. The same is true for the e-commerce market. After Taobao, Tmall, and JD.com took over the market, vertical e-commerce platforms such as Jumei Youpin, Vipshop, and Suning that were once famous in the market have gradually declined. , the market share growth rate of Tmall and JD.com continues to increase, and as a result, small-scale e-commerce platforms are gradually marginalized. Although there are many factors that affect the path of change and the intermediate processes are different, the general trend and direction will not change. The larger Evergrande, the market concentration will gradually increase, which is an inevitable result. The cloud service market will not escape this rule. A more prominent phenomenon is that Alibaba Cloud, Amazon’s AWS, and Microsoft’s Azure (referred to as 3A) have maintained a sustained growth momentum, while the market shares of most other manufacturers have continued to shrink. .

(2) Analysis of the current situation of the domestic public cloud market

On July 13, International Data Corporation (IDC) released the latest semi-annual tracking report on China’s public cloud service market. Overall, due to a good policy environment, China’s highly developed Internet industry, and a large number of traditional enterprises migrating to the cloud, the annual growth rate of the public cloud market in 2017 was as high as 64.5%, with the total volume exceeding US$4 billion for the first time. The proportions of IaaS and PaaS continue to rise, reaching 61.0% and 7.5% respectively, with the growth rate of IaaS as high as 72%. The proportion of SaaS has dropped to 31.5%. The specific share is as shown in the figure:

In China’s public cloud IaaS market in 2017, Alibaba Cloud ranked first with revenue of US$1.112 billion, with a share of 45.5%; Tencent Cloud ranked second with revenue of US$251 million, with a share of 10.3%; China Telecom ranked third, with revenue of US$185 million. , with a share of 7.6%, Kingsoft Cloud ranked fourth, with revenue of US$158 million, and a share of 6.5%. AWS and UCloud ranked fifth and sixth with a slight gap, with revenue of US$133 million and US$129 million respectively, accounting for 10% of the market share. rates of 5.4% and 5.3%. The seventh to tenth places are Microsoft Azure, China Unicom, IBM, and Huawei Cloud, accounting for 5.0%, 3.0%, 1.0%, and 0.9% of the market with revenue of US$12.1 million, US$7.26 million, US$2.54 million, and US$2.32 million respectively. .

Growth rate of China’s public cloud vendors (IaaS) in 2017 Data source: IDC China, 2018

China’s public cloud IaaS market in 2017

Data source for the growth ranking of China’s public cloud vendors in 2017: IDC China, 2018

Note: There is another version of the comprehensive ranking of domestic public cloud profits, including statistical tables for IDC and CDN businesses, in which China Telecom’s revenue is Tianyi Cloud’s revenue. In this ranking, China Unicom’s revenue includes IDC revenue, Wangsu Technology includes CDN, and 21Vianet’s revenue includes Microsoft Azure, IDC and CDN businesses.

The above data is for reference only.

2. New trends in development

(1) The public cloud market has broad prospects

1. International trends. The United States will become the world’s largest public cloud service market in 2018, accounting for more than 60% of the world’s total consumption, reaching US$97 billion, followed by Western Europe and Germany, with US$7.9 billion and US$7.4 billion respectively. market performance, it is worth mentioning that Japan and China will become the top five countries in the world leading the public cloud service market. In terms of global market performance, discrete manufacturing, professional services and banking industries together account for one-third of public cloud service expenditures in the United States. In Germany and Japan, discrete manufacturing, professional services and process manufacturing will account for 1/3 of public cloud service spending respectively. 40% and 43% of cloud spending. In China, professional services, discrete manufacturing and banking industries will account for more than 40% of public cloud spending.

Global cloud computing market size from 2011 to 2017 (unit: billion US dollars, %)

The global cloud computing industry chain has just started, with a penetration rate of less than 3%. Foreign cloud companies have chosen to cooperate with domestic IDC companies to enter the Chinese market, such as Microsoft and 21Vianet, AWS and Halo New Network, Oracle and Tencent Cloud, IBM and Wanda, etc. Recently, Apple also chose to invest US$1 billion to cooperate with Guizhou on the Cloud to build a large-scale data center in Guizhou. Similarly, domestic cloud computing companies such as Alibaba Cloud and Tencent Cloud are also vigorously deploying cloud data centers globally. So far, Alibaba Cloud has deployed more than 200 data centers in 14 regions around the world, providing better services to billions of users around the world. Provide reliable computing support. Microsoft’s SaaS service Office365 has also accumulated more than 1.2 million paying enterprises and more than 20 million users in the education industry in China, ranking first in China’s SaaS cloud application market with a market share of 23%, and achieving a cumulative three-digit average annual growth , approved by China’s Ministry of Market and Industry and Information Technology. We all believe that with the economic globalization and the large number of domestic multinational companies, it is inevitable for China’s leading cloud computing companies to deploy globally. Similarly, foreign cloud companies entering China can also enter the Chinese market as long as they meet relevant policy requirements.

2. Domestic trends: my country’s cloud computing, especially emerging industries such as the Internet of Things, are advancing rapidly. Many cities have launched pilot and demonstration projects involving power grids, transportation, logistics, smart homes, energy conservation and environmental protection, industrial automatic control, medical and health, and precision. The pilot has achieved preliminary results in agriculture, animal husbandry, financial services, public security and other aspects, and will create a huge application market. Data from various aspects show that the scale of my country’s cloud computing industry in 2019 was approximately 43 million yuan. This indicates to some extent that my country’s cloud computing industry will achieve rapid development in 2018-2019.

China’s cloud computing market size growth from 2010 to 2019 (unit: 100 million yuan, %)

In terms of the overall market, China’s public cloud IaaS market maintains rapid growth. IaaS is defined as infrastructure as a service, an IT model that provides computing and storage capabilities to social institutions and enterprises in an online manner, and only requires payment based on usage. Public cloud IaaS is still the most potential growth area in the future.

China’s cloud computing market segment size from 2014 to 2020 (unit: million US dollars)

(2) Cloud services move towards oligopoly

Cloud computing and big data are important foundations and driving forces for the development of the information economy. Since Amazon launched AWS and the birth of Hadoop in 2006, the cloud computing and big data industry has gone through its first decade. Today, the cloud computing industry has begun to enter the second stage of development, that is, the brand era represented by security, reliability and service capabilities, and with product quality and real user experience as the core. The signs of oligopoly are increasingly emerging, and the new development trend will be a disaster for small and medium-sized cloud service providers. The rapid growth of Amazon’s AWS, Microsoft’s Azure, and Alibaba Cloud will further squeeze the market space of domestic and foreign small and medium-sized cloud service providers. Where will the global cloud service market go in the future? Internationally, Amazon AWS, Microsoft Azure, Google Cloud, and Alibaba Cloud are competing for hegemony. Although Alibaba Cloud has the highest growth rate, whether it can continue to create miracles in the future requires continued attention. However, one thing can be predicted if Alibaba Cloud only relies on the Chinese market. It is still difficult for this engine to surpass Azure or even AWS in the future.

It can be seen that the public cloud IaaS market has entered a true oligarchy era, and the Matthew effect is highlighted. The strong ones get stronger, the weak ones get weaker, and the latecomers have almost no chance of making a comeback.

With the explosive development of the digital economy, cloud services will not only become the infrastructure for enterprise production, operation and management, but also indirectly provide consumers with products and services that are ultimately available for consumption. In some industries, cloud services will even directly become part of the company’s final products and services. It is conceivable that under the premise of the dual requirements of enterprises and consumers, the demand for cloud services has moved from the “nothing” stage to the stage of quality and branding.

(3) Future growth points of public cloud

According to IDC’s forecast, in the market performance of 2018, the industry with the largest investment in global public cloud services is the discrete manufacturing industry, with an investment amount of up to 19.7 billion U.S. dollars, and the professional services industry’s investment amount will reach 18.1 billion U.S. dollars, ranking second. Second, the third place will be the banking industry, with an amount of US$16.7 billion. Spending on public cloud services in the process manufacturing and retail industries will exceed $10 billion in 2018, and these five industries will remain at their peak in 2021 due to continued investment in public cloud solutions.

Market size of global public cloud target industries in 2018 (unit: 100 million U.S. dollars)

According to forecasts, the three industries with the fastest spending in the global public cloud market are professional services, telecommunications and banking. It is undeniable that for the industries that spend the most, such as the service industry and banking industry, many enterprise users have begun to recognize and favor the benefits brought by public cloud technology to enterprises. Enterprise organizations in these industries are using public cloud services to Rapidly develop and launch third-party platform solutions, such as big data and analytics, and IoT, that will enhance and optimize the customer journey and reduce operating costs.

The SaaS field will become the primary pillar industry in the public cloud market in the future. As an area that accounts for two-thirds of expenditures in the entire cloud computing market, SaaS forms the main purchasing channel and method for users by combining applications and system basic software.

Infrastructure as a Service, also known as IaaS, is becoming the second largest public cloud expenditure type. Throughout IDC’s forecast cycle, IaaS expenditures will be relatively balanced, with server expenditures slightly higher than storage expenditures. PaaS spending will be dominated by data management software, which will grow fastest during the forecast period, with a compound annual growth rate of 38.1%. Among them, application platform, integration, orchestration middleware, data access and other major methods are the most prominent.

Market share and growth rate of cloud computing market segments in international markets

The development of cloud computing in China lags behind the international market by 5-7 years, and the market size still lags far behind the international market. However, with the promotion of cloud computing-related businesses such as domestic big data, artificial intelligence, and the Internet of Things, as well as the support of my country’s policies and the continuous increase in demand, my country’s cloud computing has developed rapidly, and the market size growth rate is ahead of the world average. Although the cloud computing market started late, it has huge development potential.

Overall market size of China’s SaaS services (100 million yuan)

(4) The cloudification of carriers’ communication networks is accelerating

2018 is a critical year for the development of the communications industry. 5G is about to enter the trial commercial stage, and the application of various technologies such as the Internet of Things, big data, and artificial intelligence has entered substantial advancement. As standards gradually improve, carriers’ communication network architecture will bring about huge changes.

1. Network cloudification is a new trend in the development of 5G networks. Currently, there are many technical challenges and technical difficulties in industrialization. 5G network cloudification involves service-oriented network architecture implementation, multi-access edge computing, network slicing, 5G bearer network and network operation orchestration and other related technologies. 5G network cloudification requires in-depth analysis and evaluation of the maturity and industrialization needs of key 5G network cloudification technologies, in-depth analysis of the technical difficulties of 5G network cloudification, and active exploration of the deployment and orientation of cloud resource capabilities based on virtual machines, containers and other technologies. The system architecture design method of microservices evaluates the performance and automated configuration capabilities of the cloud network, proposes relevant technical routes, solutions and development strategies, promotes the standardization of the cloud network, and supports the implementation and deployment of 5G.

2. The 5G core network will realize the separation of control and bearer and introduce a comprehensive cloud architecture. The infrastructure layer needs to support the hybridization of virtual machines and containers. The 5G network cloud architecture will realize key technologies such as CU separation, multi-dimensional decoupling, network slicing, and multi-access edge computing for specific applications in future 5G networks. The key to differentiated experience requirements lies in the core network. It is necessary to simplify wireless docking and network-wide mobility support, solve network performance difficulties as soon as possible, and implement unified management and coordination of virtualized resources. The key to future 5G core network slicing services is to provide personalized services. To ensure business and differentiation, we strive to achieve regional planning and full life cycle slicing management of services to ensure the best end-to-end experience within and between slices.

3. China Telecom took the lead in releasing a 5G technology white paper to lay out future networks. China Telecom officially released the “China Telecom 5G Technology White Paper” at the 2018 Shanghai Mobile World Congress. This is the first time a global operator has released a white paper that comprehensively elaborates on 5G technical perspectives and overall strategies. In order to meet the diverse business needs of 5G and make the network more flexible, intelligent, integrated and open, China Telecom’s 5G network has a “three clouds” architecture.

Three clouds: access cloud, control cloud and forwarding cloud.

(1) Control cloud. The control cloud is the centralized control core of the 5G network. It completes global policy control, session management, mobility management, policy management, information management, etc., and is responsible for controlling the access cloud and forwarding cloud. Through technologies such as virtualization, network function modularization, control and bearer separation, network component function service, and network slicing, the control cloud can achieve business customization and flexible deployment, meet the differentiated needs of different new businesses, and expand network services. ability.

(2) Access cloud. The access cloud supports users’ intelligent wireless access under a variety of application scenarios and business needs, supports the efficient integration of multiple wireless access technologies, and introduces a standardized and open edge computing platform. To inspire business innovation at the edge.

(3) Forwarding cloud. The forwarding cloud cooperates with the access cloud and the control cloud to realize the service aggregation and forwarding function. The forwarding cloud realizes enhanced mobility based on the bandwidth and delay requirements of different new services under the path management and resource scheduling of the control cloud. Efficient forwarding and transmission of different business data flows such as broadband, massive connections, high reliability and low latency to ensure the end-to-end quality development requirements of the business.

(5) Popularization of driverless driving promotes distributed computing

McKinsey predicts that China is likely to become the world’s largest autonomous driving market in the future. By 2030, revenue from new car sales and travel services related to autonomous driving will exceed US$500 billion, and autonomous driving will account for 15% of the total passenger mileage (PKMT). About 13%, it will reach about 66% by 2040. By 2030, the number of driverless passenger vehicles will reach approximately 8 million; by 2040, the number will reach approximately 13.5 million. Total self-driving car sales will reach approximately $230 billion by 2030 and approximately $360 billion by 2040. By 2030, the order value of autonomous driving-based travel services will reach approximately US$260 billion, and by 2040 it will reach approximately US$940 billion. (As shown in the picture)

As the degree of autonomous driving of cars increases, the data generated by the cars themselves will become increasingly large. According to estimates by Intel, assuming a driverless car is equipped with sensors such as GPS, sonar, cameras, radar, and lidar, the data generated by the above sensors per second (as shown in the figure) will be:

GPS: about 50kB/s;

Sonar: about 10-100kB/s;

Camera: about 20-40MB/s;

Radar: about 10-100kB/s;

Lidar: about 10-70MB/s.

Adding up the numbers above, a self-driving car will generate approximately 4,000GB of sensor data to be processed every day. Automakers, IT companies and technology companies have to face a complex problem: how to enable self-driving cars to process such massive amounts of data in real time and draw logical and safe driving conclusions based on the extracted information. behavioral decisions.

The two key links to solving the above problems are: 1. Where is the data processing done? Is it in the central processing unit of the car or in the cloud computing center? 2. If it is completed in the cloud computing center, what kind of network connection is used? 5G, 6G? What should I do in the signal blind area?

How to solve the problem is beyond the scope of this article, but one thing is that whether it is distributed deployment of edge clouds in cars or centralized processing of data on cloud base cloud hosts, they are promoting the rapid development of the cloud host market. Therefore, cloud operators are now It would be a good time to embrace autonomous driving technology companies. In fact, Amazon AWS, Microsoft Azure, and Alibaba Cloud, the three largest cloud service providers in the world, have all entered the field of autonomous driving.

Recommended in this article: Combustible and toxic gas monitoring system